AlphaSense vs. Tegus: Key Differences

Tegus is one of AlphaSense’s top competitors. In this guide, we will cover the key differences between the two platforms—from strengths and weaknesses to in-depth feature comparisons—as well as what and whom each tool works best for.

Notably, some clients utilize a more is more strategy, finding value in utilizing both AlphaSense and Tegus—as each offers a unique set of proprietary insights and capabilities that when combined, result in a highly effective and comprehensive business strategy.

AlphaSense

AlphaSense is a leading all-in-one market intelligence platform and smart search engine. It’s the ideal tool for research and business professionals—from analysts and financial researchers to corporate professionals—looking to implement a qualitative research strategy powered by proprietary AI technology and automation.

Financial professionals use AlphaSense to access 10,000+ premium sources of information, including trade journals, SEC filings, and company filings.

Moreover, AlphaSense provides access to broker research and an expert call library that facilitate deeper insight into companies and markets. These extra resources are accessible through two AlphaSense content sets:

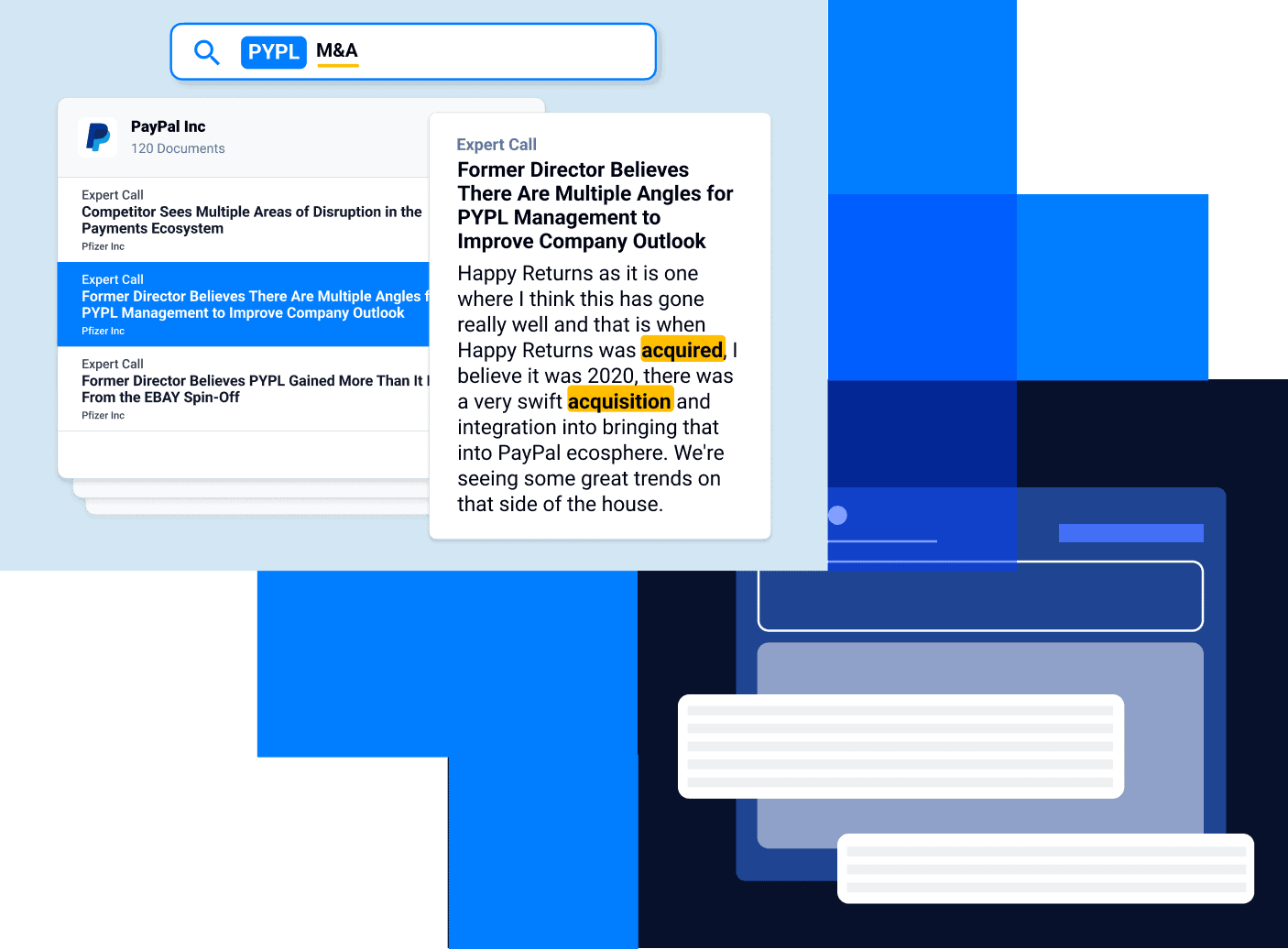

- Expert Insights – 40,000+ transcripts of one-on-one calls with industry experts, customers, professionals, competitors, and former and current executives, available as an add-on to the AlphaSense package.

- Wall Street Insights® – A collection of broker research from Wall Street’s leading firms, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, available within the AlphaSense platform. The best part? Research professionals can preview the contents of a broker report, saving them wasted time and money on potentially fruitless research.

Unlike other research tools, AlphaSense incorporates smart search capabilities within its platform, empowering users to find everything needed for their research without manually toggling between multiple tabs. AlphaSense search also comes with added features like:

Smart Synonyms™

Smart Synonyms™ technology is an AI-supported feature that can recognize both the keywords and search intent behind a query.

AlphaSense uses advanced algorithms to eliminate noise from your search (i.e., content with matching keywords but ultimately irrelevant to your search objective) and leverages variations in language (for example, “impact investing” vs. “ESG investing”) to pinpoint the exact information you need.

AI search functionality allows you to easily find the exact documents and snippets that are most relevant to your search, giving you back time and energy to spend on more high-level tasks, like analysis.

Sentiment Analysis

AlphaSense uses NLP in its sentiment analysis technology to identify differences in a text’s tone and subjective meaning. It then uses color coding to help readers identify the document’s positive, neutral, and negative sentiments.

Expert Insights also allows you to quickly pick up on sentiment shifts in the expert interviews that go beyond surface-level commentary.

This award-winning technology assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments across time. Users can take advantage of it to make better-informed investment decisions and improve their risk management strategies.

Smart Summaries

Unlike other generative AI (genAI) tools that are focused on consumer users and trained on publicly available content across the web, AlphaSense takes an entirely different approach. As a platform purpose-built to drive the world’s biggest business and financial decisions, our newest Smart Summaries™ feature leverages our 10+ years of AI tech development and draws from a curated collection of high-quality business content.

With Smart Summaries™, you can glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees.

Integrations and APIs

It’s now becoming industry standard for many market intelligence platforms to offer integration of internal content containing both structured and unstructured data, but it’s key that this content is indexed and immediately available. A market intelligence platform should also offer the ability to upload new external content sources (such as RSS or web content), so that you can leverage the platform’s analysis tools to pull relevant insights.

AlphaSense provides integration with commonly used programs like OneNote, Sharepoint, and Evernote, enabling streamlined collaboration with members across your organization and improving team productivity. It also allows you to search across all internal and external company content to find key insights, and the proprietary AI technology catches what other platforms miss in a secure and automated way.

Automated Monitoring

Instead of wasting hours manually monitoring, AlphaSense offers real-time alerts to keep users updated with trending topics, companies, and industries of interest. Users can also take snapshots of multiple companies frequently within the AlphaSense platform, staying in touch with the most critical insights, news, and market changes they need to know.

Exceptional User Experience

AlphaSense is built to fit into a user’s processes and workflow seamlessly. In addition to an intuitive user-friendly interface to display data and information, it allows professionals to export crucial data to their mobile devices or PCs. AlphaSense also boasts exceptional customer service—product specialists are readily available 24/7 to assist with putting together searches—which users find massively helpful in streamlining workflows.

AlphaSense Pros:

- Extensive content universe organized around the four key perspectives

- Proprietary content sets like Wall Street Insights® and Expert Insights

- NLP and AI-based search technology and sentiment analysis

- All-in-one research platform

- Intuitive user interface

- Collaboration and integration features

- Automated and customizable alerts

AlphaSense Cons:

- Visualization tools are limited to financial data at this time

- Collaboration tools are limited to users with AlphaSense licenses

Tegus

Tegus is a financial research company that offers critical financial insights to buy-side investors through their searchable platform. This company keeps over 40,000 searchable expert call transcripts in its database, including private and public companies.

Within the Tegus platform, users can search, annotate, analyze, and explore multiple research materials to gain insight into companies, current and former executives, employees, and consultants. Moreover, users can also request and source custom expert calls with industry experts.

Here are some features available on the Tegus platform:

Tegus Call Services

Users can access thousands of expert calls on the Tegus platform to acquire key insights into businesses, companies, and market sectors. Using custom-recruited experts from Google, LinkedIn, and other platforms, Tegus creates new and tailored expert calls and transcripts for users.

Customers can ask specific questions and receive insights from pre-qualified experts at an average fee of $325/hour. Tegus does due diligence to ensure that buy-side users speak to experts securely and review resulting transcripts for compliance.

Tegus For Experts

Tegus also enables industry experts and professionals to make an extra income by giving insights that may increase innovation, solve problems, improve decision-making, and generate new ideas. Pre-qualified experts can consult on Tegus at their chosen rates, which poses a lucrative incentive for their participation in the platform.

They can also build and join an expert network, engage with new companies, and explore new opportunities through Tegus on a secure platform.

BamSEC

The BamSEC platform on Tegus enables users to search across multiple companies and SEC filings. Customers can use these documents to perform due diligence on companies and explore performance metrics efficiently.

Using the tables on BamSEC, users can explore past filings, create models, and benchmark company performance, all in one place, without needing to pull up individual filings to manually track a company’s metrics.

Compliance

Tegus allows customers to search, explore, and detect potential compliance risks or violations. The platform uses over 40 compliance experts to ensure all calls meet SEC, FINRA, and EU regulations without creating conflicts of interest or other potential violations.

Using its internal compliance tools, users can manage company-specific protocols and their team’s Tegus activity in expert calls and resulting transcripts

Tegus Pros:

- Massive database of over 55,000 expert call transcripts

- Access to the expert network industry

- Experts and industry professionals are prequalified before joining the platform

- Users can request custom calls with experts

- Tegus follows multiple compliance regulations across the US and Europe

- Access to SEC filings of multiple private and public companies

Tegus Cons:

- No advanced AI search and smart synonym feature

- No sentiment analysis

- No access to broker research or other high-value content sets

- Little access to resources outside of expert calls and SEC filings

- No support for internal content

AlphaSense vs. Tegus: Feature Comparison

Get started today

Trial AlphaSense to see how it compares to Tegus.

Start my free trial