When reading expert transcripts in the AlphaSense library, you may often find yourself captivated by valuable insights that spark critical questions. But wouldn’t it be incredible to connect directly with the expert, delve deeper into their perspective, and unlock personalized insights beyond the transcript?

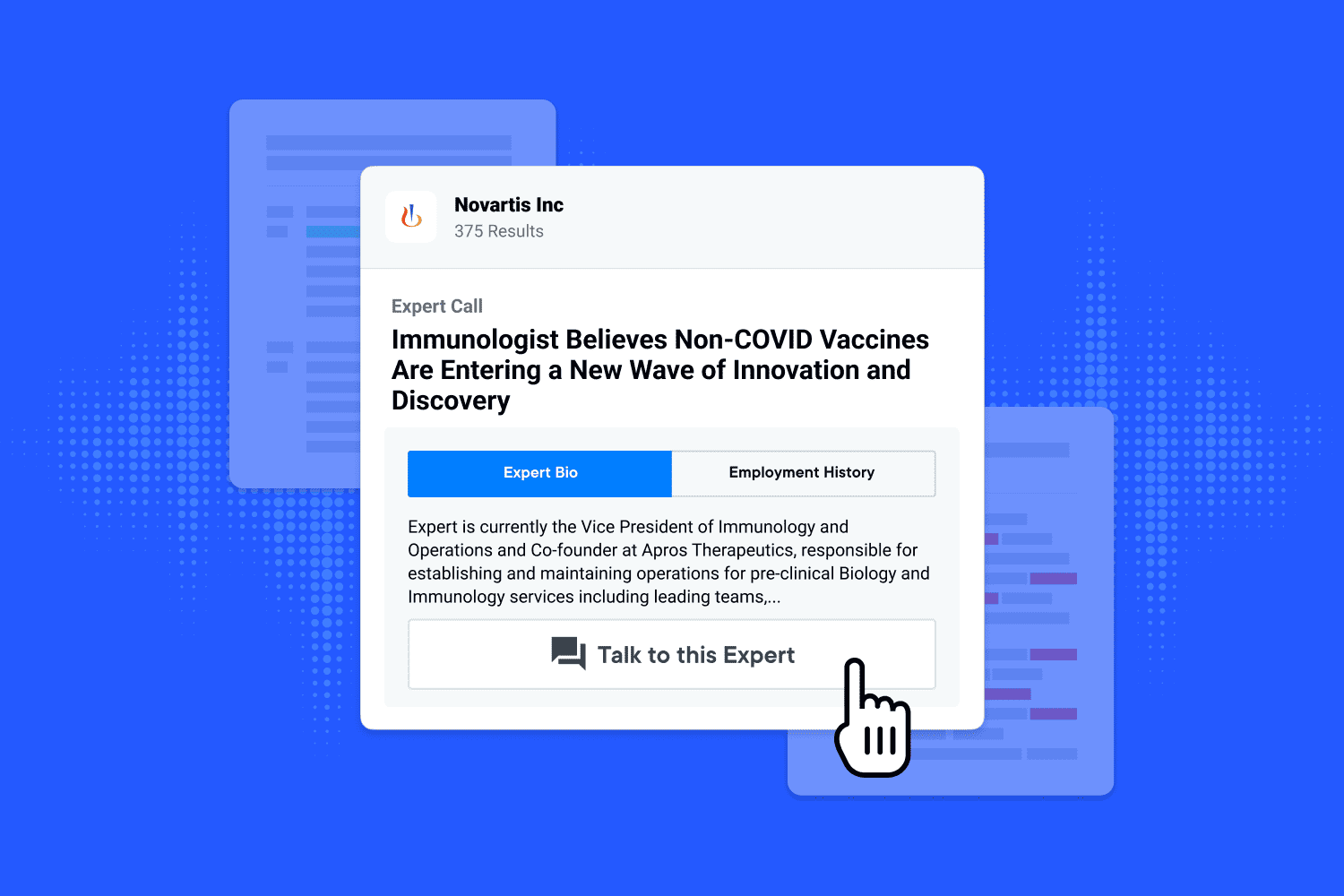

Enter “Talk to This Expert,” a user-friendly feature available in the AlphaSense expert transcript library. This useful button is embedded within each expert transcript in our library and serves as your direct line to industry-leading minds. With the click of a button, you can leverage our Expert Call Services to dive beyond an expert transcript, engage in custom one-on-one calls, and gain deeper insights you can’t find anywhere else.

AlphaSense is a leading market intelligence platform that combines a diverse content universe with artificial intelligence (AI) power and easy scheduling capabilities with quality experts to maximize your return on investment (ROI).

With centralized access to our Expert Insights, business professionals can streamline their workflow and seamlessly transition between data-driven research and qualitative research to inform their business decisions. Below, we explore how you can benefit from personalized expert calls by using the “Talk to This Expert” button in our expert transcript library.

Dive Beyond the Transcript into Personalized Insights

Expert transcripts are dense with critical information and serve as a valuable resource for primary qualitative research. However, sometimes specific questions may arise in your primary research process that demands a nuanced response from a human expert. This is where “Talk to This Expert” can serve as a powerful tool to enhance your primary research with personalized insights from industry experts through tailored interviews.

By clicking this button, you can initiative our Expert Call Services and schedule a one-on-one call with the transcript’s subject matter expert to gain:

- Last-Mile Insights – Request clarification on specific topic points to ensure a comprehensive understanding of the expert’s perspective to fill gaps in your investment process.

- Personalized Answers – Address your burning questions and identify potential red flags with expert insights most relevant to your individual research needs.

- Fresh Perspectives – Hear the expert’s most recent insights unavailable anywhere else to gain a competitive edge.

The “Talk to This Expert” button is found on every expert call transcript available in our extensive expert transcript library to ensure you have the opportunity to dive deeper into any transcript.

Surface Relevant Experts in AlphaSense’s Expert Transcript Library

The AlphaSense expert transcript library and Expert Call Services provide a synergy of services that can reduce your quantity of unnecessary calls, all within a single, streamlined platform. AlphaSense users can utilize the expert transcript library as a powerful vetting process for industry experts by reading an expert’s background and transcript content prior to conducting a custom call.

Unlike traditional expert networks, our expert transcript library allows you to assess your match potential with an expert profile prior to a custom call, rather than discovering a mismatch after conducting the call. Additionally, with over 40,000 expert transcripts in the AlphaSense library, you have access to tens of thousands of expert profiles to dive into deeper discussions with.

And while that may sound like finding a needle in the haystack, AlphaSense’s powerful AI allows you to effortlessly navigate across an extensive expert transcript library with smart search capabilities to conduct fast-paced research. Leveraging 10+ years of investment in AI technology, you can quickly surface relevant experts that you’d like to gain personalized insights from and easily connect with pre-qualified experts by clicking “Talk to This Expert.”

Discover Actionable Insights with Talk to This Expert

AlphaSense’s all-in-one platform creates uninterrupted workflows and makes connecting with the right experts easier than ever. Once you’ve found an expert who has the exact experience you’re looking for, a direct call is just a few clicks away as seen below.

Additionally, by leveraging powerful AI capabilities, you can quickly surface transcripts with experts who possess your desired expertise, background, role, and perspective for your next call. Here’s how:

- Surface Relevant Transcripts – Utilize smart search filters, Smart Synonyms™, sentiment analysis, and automated alerts to pinpoint relevant transcripts with ease.

- Glean Instant Insights – Generate accurate summaries of key expert viewpoints using Smart Summaries powered by generative AI technology and glean crucial information at a glance.

- Dive Beyond the Transcript – Click the “Talk to This Expert” button on any transcript to easily initiate our Expert Call Services and dive deeper with a personalized call to capture nuanced insights that only direct conversations can provide.

Discover actionable insights using the “Talk to This Expert” button which allows you to seamlessly transition between comprehensive primary research and deeper qualitative research with the click of a button.

Confidence in Every Connection with Pre-Qualified Experts

Engaging with experts that have the right background, expertise, knowledge, and content disclosures is critical when conducting primary market research across a range of industries. AlphaSense understands the importance of compliance and the nuanced risks associated with breaches and exposure to material non-public information (MNPI) for every industry.

That’s why the “Talk to This Expert” button only connects you with pre-vetted, qualified industry experts to ensure that every interaction you have with an expert provides quality insights along with compliance safeguards.

Our rigorous qualification process for industry experts and investment analysts guarantees:

- Industry Leading Compliance – Trust in our industry-leading compliance and rigorous vetting process that mitigates your risks of exposure to MNPI and connects you with reliable experts for safe and quality calls.

- Customizable Compliance Solutions – Leverage our customizable compliance programs that tailor solutions to your company-specific standards and laws to ensure each call adheres to your compliance needs.

- Domain-Specific Expertise – Connect with experts who specialize in your exact area of interest and deep industry knowledge to extract granular insights tailored to your unique research needs.

Conduct the perfect expert call with ease of mind through our reliable Expert Call Services and trustworthy experts so that you can make business and investment decisions with full confidence.

Maximize Your ROI with Expert Call Services

AlphaSense’s Expert Call Services maximizes ROI by reducing the costs associated with getting every perspective you need to outperform competitors. Leveraging the combined power of the AlphaSense expert transcript library and custom expert calls allows you to achieve your research objectives with efficiency and cost-effectiveness.

Expert Call Services provides you with access to more than one million pre-qualified expert profiles spanning all industries and diverse operator perspectives—such as thought leaders, former executives, customers, partners, and competitors. This wide range of expert perspectives ensures that you have comprehensive coverage to maximize the full value of your expert call.

Save time and resources by conducting your initial research with comprehensive insights found in the expert transcript library to address the bulk of your research needs. Then, utilize Expert Call Services for targeted consultations on complex, nuanced, or recent information to reach that last mile in your research. This strategic approach ensures you get the most value from your research budget by limiting the quantity of expert calls you need and optimizing the quality of each call.

With our competitive pricing structure, you can conduct more high-value calls and maximize your return on time.

Discover how you can reach your full research potential in our infosheet, 4 Ways to Maximize Your Primary Research with Expert Call Services.

Unlock The Power of Personalized Insights

AlphaSense’s “Talk to This Expert” is more than just a feature; it’s a bridge that connects disparate pieces of your research, providing you with a 360-degree perspective through nuanced insights from human experts. This helpful button allows you to quickly connect with pre-qualified experts to streamline your workflow and gain last-mile insights that fill in gaps in your market research.

Ready to unlock the power of personalized insights with the click of a button? Start your free trial today to take it for a test drive.