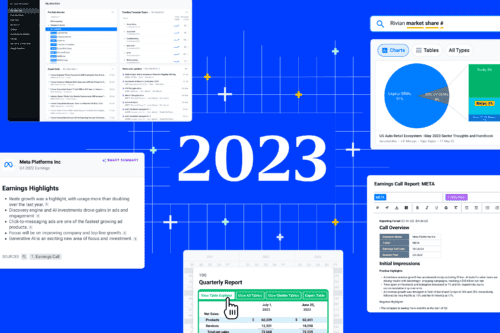

Product10 min read

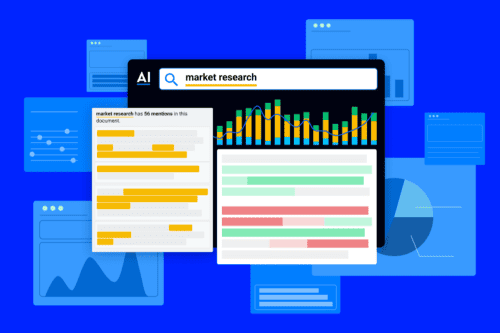

Maximize Investment Research ROI with Expert Insights

In the ever-evolving landscape of investment research, maximizing returns while minimizing costs is paramount. Leveraging firsthand perspectives from first-hand, company...